When you sit behind the wheel of a car, the first thing you do is buckle your seat belt – not because you expect an accident, but because you know the road ahead can be unpredictable.

A seat belt doesn’t stop the bumps, potholes, or sudden brakes—but it protects you when those events happen.

In investing, Asset Allocation is that seat belt for your wealth. Market volatility is like those sudden curves and slippery roads. Equities may be the engine that drives long-term growth, but relying only on them can leave you vulnerable in turbulent times. That’s where the protective role of asset allocation comes in—by blending equity with other assets like gold and debt.

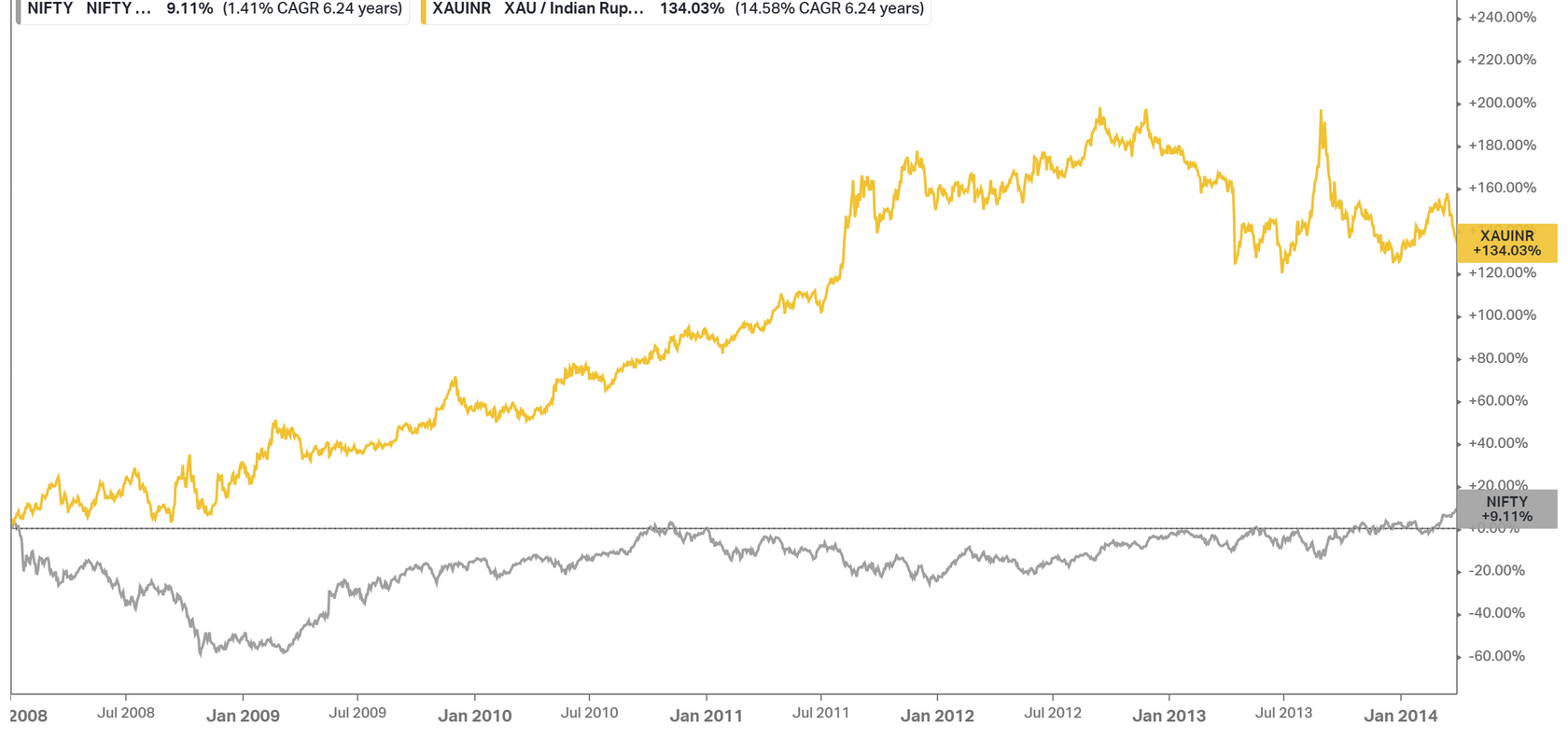

Take the period from 2008 to 2014. Equity markets (Nifty) went through a rollercoaster, delivering just 1.4% annualized returns over 6 years. For investors solely dependent on equities, it was like driving without a seat belt through a storm. But add a “flavor” of gold, and the story changes—gold prices surged more than 134% during the same time, cushioning portfolio losses.

XAUINR – Gold price in Indian Rupees, not adjusted for duties & taxes

Gold has some unique qualities that make it stand out –

A well-balanced portfolio isn’t built on equities alone — adding gold provides the stability needed to weather uncertain times. It’s a reminder that true wealth lies not just in growth, but in protection too – that is, in balancing risk and reward.