A few years ago (pre-2020), trading as a side income was largely viewed as a high-risk gamble for amateurs. Post-COVID, it exploded into a mainstream “side hustle” for millions of young Indians, glamorized by apps and social media.

A few years ago (pre-2020), trading as a side income was largely viewed as a high-risk gamble for amateurs. Post-COVID, it exploded into a mainstream “side hustle” for millions of young Indians, glamorized by apps and social media.

India had only 4 Cr Demat accounts at the end of year 2020 and now that number stands at 21 Cr, a jump of more than 5X in five years. The Nifty 500 index has nearly doubled during the same time.

This broad based rally was so lucrative that many people started trading (Swing / Intraday) either in stocks or in derivatives (Futures / Options) as a side job, targeting side income to their core jobs in other fields.

Can Share market trading become a reliable part-time or side-pocket job? What are the core challenges and is it really rewarding?

Time cost: It’s not “on the side” – Intraday and Swing trading requires constant monitoring, rapid decisions, and the emotional ability to handle sharp losses, making it almost like a second full‑time job. For someone already working long hours in IT, this is rarely sustainable.

Emotional cost: Most are not wired for it – Many young traders underestimate the emotional load; constant P&L swings often lead to revenge trading, FOMO, and bigger losses over time.

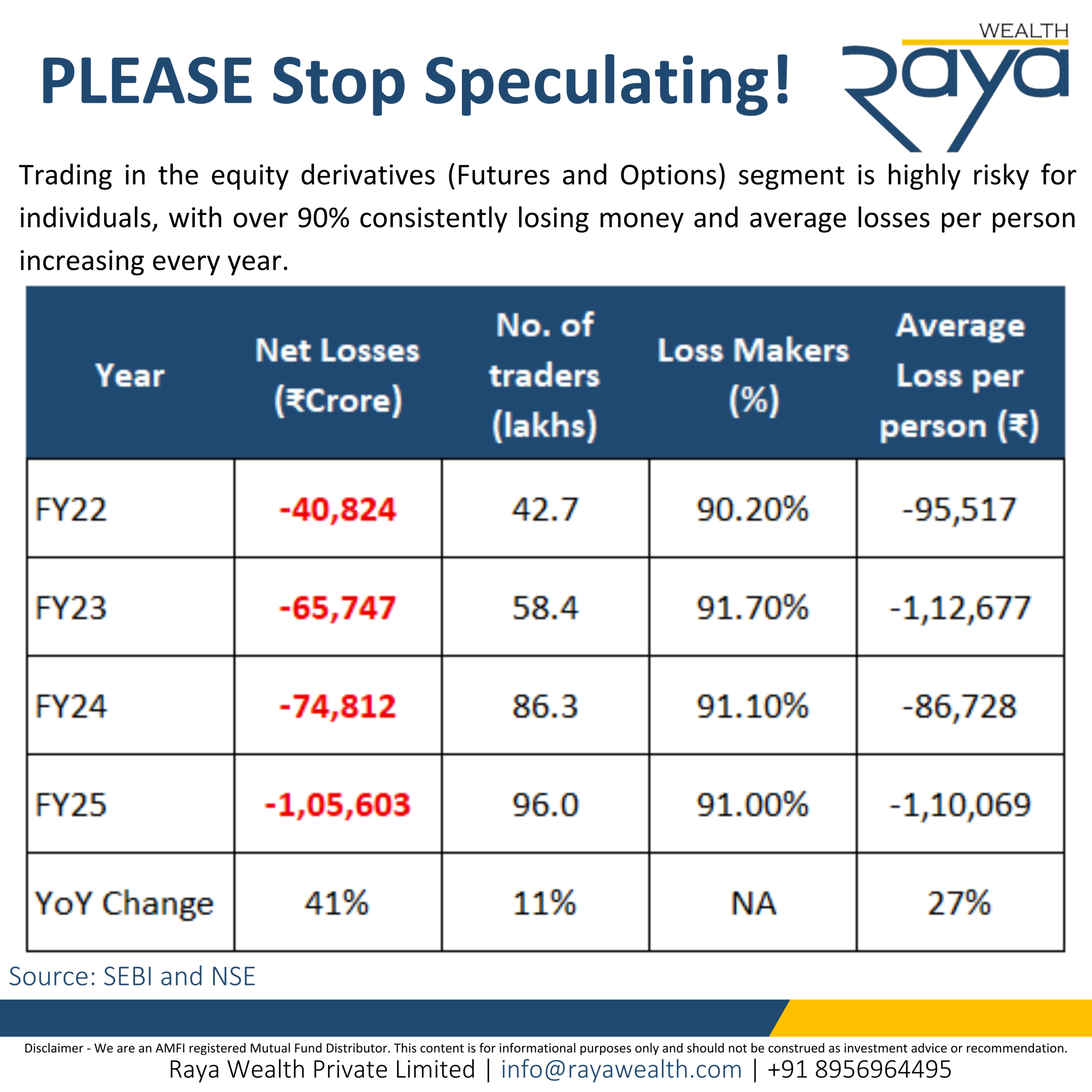

Statistical reality: Odds are stacked against you – As per market regulator SEBI, Trading in the equity derivatives (Futures and Options) segment is highly risky for individuals, with over 90% consistently losing money and average losses per person increasing every year.

For most salaried professionals, trading is at best a risky hobby, not income replacement. Your real edge is not intraday tips or complicated indicators – it is your stable salary, high future income potential, and decades of time in front of you. Use that to your advantage.